puerto rico tax incentives code

60-2019 hereinafter the Incentives Code. Fixed income tax rate on eligible income.

Form 480 Puerto Rico Fill Out And Sign Printable Pdf Template Signnow

Corporate - Tax credits and incentives.

. On July 1st 2019 the Governor of Puerto Rico signed into law House Bill No. The Incentives Code eliminates the 90 exemption and instead establishes a flat 4 tax rate on TDI. Act 20 Act 22 Act 27 Act 73 Act 273.

Last reviewed - 21 February 2022. It offers the following main tax benefits. The new regulation for Puerto Rico Incentives Code 9248 became effective on January 20th 2021.

Back in tradeable tax credits on RD expenditures. If you cant read this PDF you can view its text here. Promotes the environment opportunities and adequate tools to foster the.

Tax on Capital Gains Dividends Interest Crypto Gains1 Up to 50. Many high-net worth Taxpayers are understandably upset about the massive US. Few places on earth offer a return on investment the way Puerto Rico does.

Puerto Rico Incentives Code Act 602019 Signed into Law. SAN JUAN PR November 8 2019 Governor of Puerto Rico Ricardo Rosselló signed Act 602019 commonly known as the Puerto Rico Incentives Code into law on July 1 2019 with an effective date of January 1 2020The Incentives Code consolidates various tax decrees incentives subsidies. DLA Piper - Manuel López-Zambrana Andrés Fortuna-García.

This Code is approved with the conviction that it shall improve Puerto Ricos economic competitiveness. The 105 and 15 rates would apply regardless of whether the taxpayer can claim a credit for the tax paid to Puerto Rico in the US or a foreign country. Also adds a section on the exempt nature of distributions from TDIs EP.

The Puerto Rico Incentives Code Act 60 helps build a vibrant community by promoting economic growth through investment innovation and job creation. 21 of 14 May 2019 also known as the Development of Opportunity Zones of Economic Development Act of. Once the decree expires the taxpayer would have to apply for a new tax decree under the Puerto Rico Incentives Code of 2019 also known as Act 60 to continue to benefit from the alternate fixed income tax rate.

1635 known as the Incentive Code of Puerto Rico and enrolled as Act No. 60 known as the Puerto Rico Incentives Code which consolidates the dozens of decrees incentives subsidies reimbursements or tax or financial benefits existing at the date of its approval. Through this regulation provisions for Act 60 of 2019 known as the Puerto Rico Incentives Code went into effect with the purpose of establishing the norms requirements and criteria to be used in the application and awarding of the benefits granted under this law.

Fixed income tax on eligible income. The 105 and 15 rates would apply regardless of whether the taxpayer can claim a credit for the tax paid to Puerto Rico in the. The purpose of the bill was to consolidate all tax and monetary benefits conferred through separate statutes into a single code and eliminate tax incentives that were.

The Governor of Puerto Rico on 1 July 2019 signed into law House Bill 1635 into Act 60-2019 known as the Incentives Code of Puerto Rico the Incentives Code. Puerto Rico Act 60 Incentives Code Puerto Rico Act 60 Incentives Code Tax Implications. In order to bolster a diversified economy the local government has.

Sometimes effective tax planning can help avoid these taxes. With an ever-growing array of services and emerging industries part of your success will be directly attributable to the incentives available. The remaining 10 is subject to the applicable tax rates under the Puerto Rico Internal Revenue Code as amended the PRIRC.

Puerto Rico to offer investors from the US and all parts of the world a unique business and legal environment. Puerto Rico Tax Incentives. Back in tradeable tax credits on RD expenditures.

The Incentives Code consolidates incentives granted for diverse purposes throughout decades like manufacturing activities and. Puerto Rico July 6 2022. The purpose of Puerto Rico Incentives Code 60 is to promote investment in Puerto Rico by providing investment residents with tax breaks.

Taxes levied on their employment investment and corporate income. Until the enactment of Act 60-2019 PRs incentives program was covered in multiple pieces of legislation that had been put in place over many years. Puerto Ricos Incentives Code.

As provided by Puerto Rico Incentives Code 60. On 1 July 2019 the Governor of Puerto Rico signed into law Act 60 also known as the Puerto Rico Tax Incentives Code Incentives Code which consolidated dozens of tax decrees incentives subsidies and tax benefits in a single statute including Act No. Once the decree expires the taxpayer would have to apply for a new tax decree under the Puerto Rico Incentives Code of 2019.

Act 60-2019 also known as the Puerto Rico Incentives Code. Act 22 - The Individual Investors Act now included under Act 60 of PR Tax Incentive Code of July 2019 Act 22 as amended also known as The Individual Investors Act was approved by the Legislative Assembly of Puerto Rico during 2012. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investorsIn a recent attempt to strengthen its economy and attract investors the local government has stepped up its economic and tax incentives for those wanting to do business here.

Puerto Rico Tax Haven Is It An Offshore Jurisdiction

Puerto Rico Tax Haven Is It An Offshore Jurisdiction

How Puerto Rico Became Legalized Marijuana S Boomtown Hoban Cannabusiness Law Firm

How To Comply With Puerto Rico S Notice And Reporting Requirements

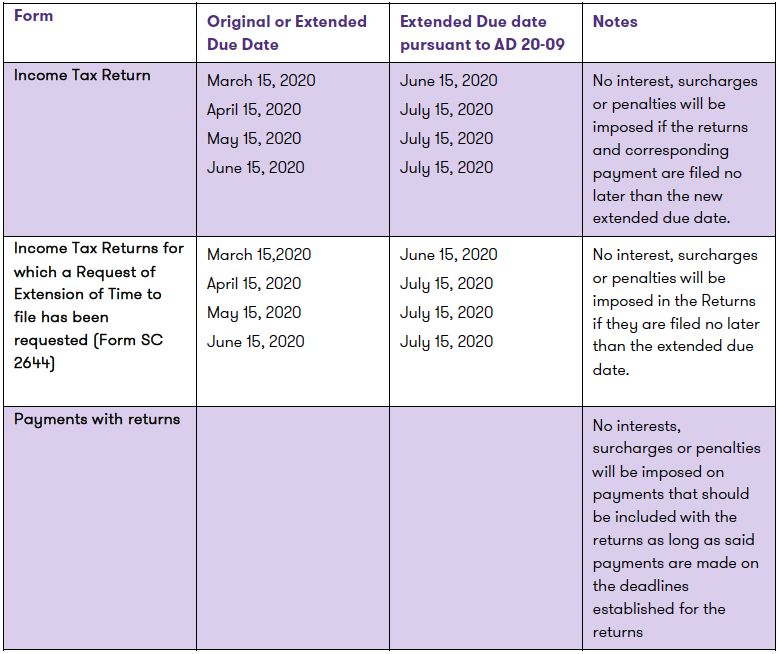

New Deadlines Established By The Puerto Rico Treasury Department Pursuant To Ad 20 09 Grant Thornton

Puerto Rico Tax Incentives Young Entrepreneurs

A Global Americans Review Of Boom And Bust In Puerto Rico How Politics Destroyed An Economic Miracle

Puerto Rico Woos Rich With Hefty Tax Breaks Marketwatch

Puerto Rico Tax Incentives Young Entrepreneurs

Examining Puerto Rico Tax Regime Changes

New Deadlines Established By The Puerto Rico Treasury Department Pursuant To Ad 20 09 Grant Thornton

2021 Puerto Rico State Hazard Mitigation Plan By La Coleccion Puertorriquena Issuu

Examining Puerto Rico Tax Regime Changes

Is Puerto Rico Collapsing Quora

Puerto Rico Tax Haven Is It An Offshore Jurisdiction

Ocyonbio Seeks Fda Gold Star For Puerto Rico Biosimilar Manufacturing Generics Bulletin

University Of Puerto Rico Rio Piedras Campus Puerto Rico Puerto Rico Usa Beautiful Islands